Are you planning to invest your funds in the stock market but lack time to investigate your trades? Or, are you planning to start your stock trading business and looking for easy options to operate buying and selling transactions automatically? In either of these cases, the stop-loss will help you with the best monetary benefits.

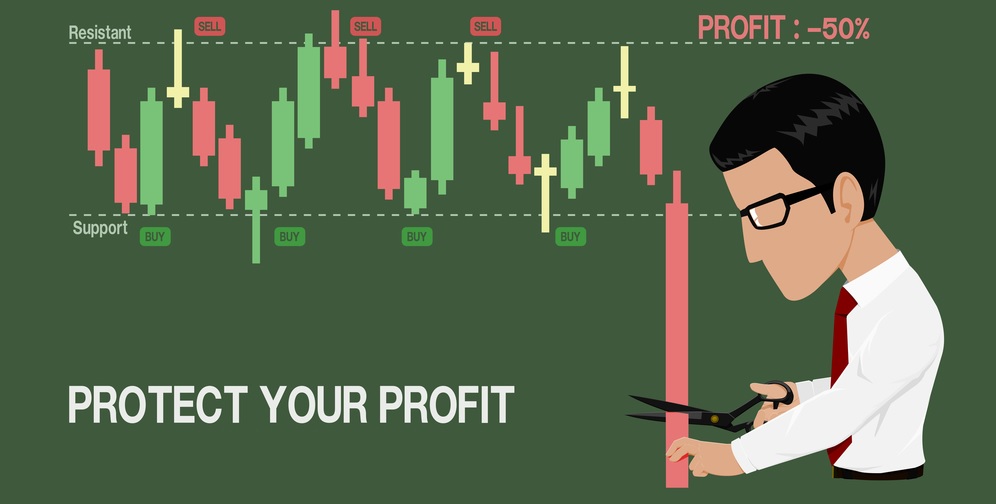

Stop loss is an influential method investors and traders use to limit their losses or increase their gains. An automatic order is placed at a fixed price to sell or purchase a property. But, can you set stop loss orders without knowing a company's financial history?

Stock market volatility poses high risks for investors. Besides, profits can also lead to huge losses if the market fundamentals are not understood. Before setting any pre-price limit for assets, an investor or trader must be well-versed in the company's financial and technical analysis to lock in their profits.

NIWS: National Institute of Wall Street is a ranked stock market institute in Jaipur with highly trained, certified, and experienced expert stock traders. We aim to prepare our students with the best course modules certified from NSE, NCFM, BSE, SEBI, and NISM, offering promising career opportunities with a 100% job placement guarantee.

Let's find out from our experts the details of what stop loss means in the share market and reveal how this simple strategy can provide lucrative benefits if applied with the ideal set of rules and procedures.

A stop-loss order is placed with the broker to buy or sell assets, where the broker pre-sets the share's buying or selling price. It is an ideal strategy for long-term and short-term trades, limiting losses and helping investors increase profits.

For a comprehensive understanding, let's relate it to an example: Suppose Vicky holds 100 shares of Adani Wilmar, which he purchased at Rs. 400 per share, thereby investing a total amount of Rs. 4000/-. For some reason, the price for this share started falling and reached Rs. 300 per share.

To waive the chances of his huge losses, Vicky asked his broker to place the stop order for his shares at Rs. 380, bearing a loss of Rs. 20 on each share. Now, whenever the share hits this set price limit, the system automatically executes this trade, booking Rs. 20 losses on each share.

But to execute stop-loss trades, an investor needs to be familiar with financial charts and options strategies. They must also have the technical knowledge of trends and patterns to figure out whether this circuit will last for longer or is an opportunity to grab immediately.

One of the primary purposes of placing stop-loss orders is to limit loss and lock in profits at a specific price. It is like placing automatic orders for the assets you wish to sell or purchase before reaching below or above the pre-determined price. An investor needs to know that every trade requires a different strategy.

If you are an active investor in the stock market, stop-loss strategies might not offer lucrative benefits.

A stop-loss strategy is not ideal for large stocks, as they are likely to lose or gain more in the future.

One of the biggest mistakes most brokers make is missing confirmation. Always wait for confirmations on stop-loss orders to ensure that they are directed at the desired price.

Stock brokers charge a different fee for stop-loss orders. Therefore, investors must clarify these extra charges before executing any orders.

There are three different types of stop-loss orders-

Stop Loss Market Order:

Stop Loss Market Order is when you pre-set the specific price for your asset to prevent loss and sell off the same at the set limit. For example, if you place the market loss order for Rs. 100 for each share at Rs. 90, the trade will be executed automatically if it reaches the set limit.

Trailing Stop Loss Order:

Executing or booking orders at percentage gives more clarity than price. Trailing stop loss orders is an advanced stop loss version that allows you to pre-set the price limit in percentage.

Suppose you purchased a stock at Rs. 200 and placed a stop loss order at Rs. 180. The system will execute this trade once the stock hits this amount. Let's revise this. Suppose you purchased the stock at Rs. 200 and placed a trailing stop loss order at 10% of the market price. Whenever the stock price falls, it will be sold.

What if the stock hits an all-time high of Rs. 240? How will this order be executed? This is where the trailing stop loss order's advantage is highlighted. In this case, the trailing stop loss order price will change to Rs. 216, 10% of 240.

Stop-Loss Limit Order:

Sometimes, there is a chance that the stock's price might not hit the pre-set range and fall lower than the specific price. In this case, a stop-limit order will help save the losses.

Suppose you purchased a stock at Rs. 100/—and set a stop loss limit order at Rs. 90/-. Now, along with the limit order, the investor or broker also needs to mention the trigger price, say Rs. 89, which must be lower than the stop loss price. Whenever the stock reaches Rs. 90, this set order will be triggered but sold at a price between 89 and 90, say 89.75 or 89.80.

Automated Technology:

In stop-loss orders, brokers or traders must monitor stocks uninterrupted during market hours. After setting the price limit or range, the orders are automatically triggered when the stock reaches its limit.

Loss Cutting Method:

The stock market is a sweet trap, sometimes leading to ugly losses. A stop loss ensures that your assets book the least possible loss from falling prices.

Disciplined Trades:

To grab the most out of your career placement in the stock market, you must detach yourself from market emotions for extended survival. Stop loss helps you stick to an ideal strategy and promotes discipline in your trading career.

Selling Stocks Early:

In stop-loss orders, you restrict yourself from the benefits your asset might deliver in the future and exit the trade in its initial phases.

Moreover, some new investors may be unable to decide the limit for stop-loss orders. Therefore, it is essential to explore the concept or seek help from investment advisors before finalizing any price range.

Short Term Fluctuations:

Another major disadvantage of stop-loss trades is that you withdraw your holdings from the market during short-term fluctuations. The order is triggered as soon as it hits the price limit, adding a risk element for investors.

The stock market is volatile and experiences minor or significant fluctuations in daily trades. Therefore, you must allow your stock to move a little before booking profits or losses. An investor must know the trading strategies to cover the losses in short-term fluctuations or when to wave off from the market.

Placing Stop Loss Orders at Random Numbers:

Investors must not place stop-loss orders based on arbitrary numbers. To identify stop-loss orders, investors need to be well-versed in the company's fundamental and technical analysis.

NIWS expert stock traders teach their students the best advanced technical analysis concepts, facilitating profitable deals for beginners.

Not Determining your Position before Placing Stop Loss Orders:

An investor must know the position they will take before placing stop-loss orders. It furthermore helps remove the emotions from the stock market, allowing investors to go through the benefits of open trade before setting any price limit.

Stopping loss is an ideal strategy for investors or traders to limit their gains and losses. But before placing any stop loss order limit, an investor needs to figure out his position where they will land in open trade and the risk appetite they can bear.

To benefit from a stop-loss strategy, an investor needs to know the basics of the stock market and the company's stock. NIWS offers the best stock market course in Jaipur, where an investor or trader can learn all the stock market strategies and facilitate smart investments.

Book your Free Demo with our experts to clear your queries and discover how our expert tips will help you with promising career opportunities in the stock market.

Start with a demonstration class.