Best Stock Market Institute in Jaipur – NIWS

Your Path to Financial Freedom Starts Here: Expert-Led Stock Market Courses in Jaipur

Courses Overview

Why Choose NIWS

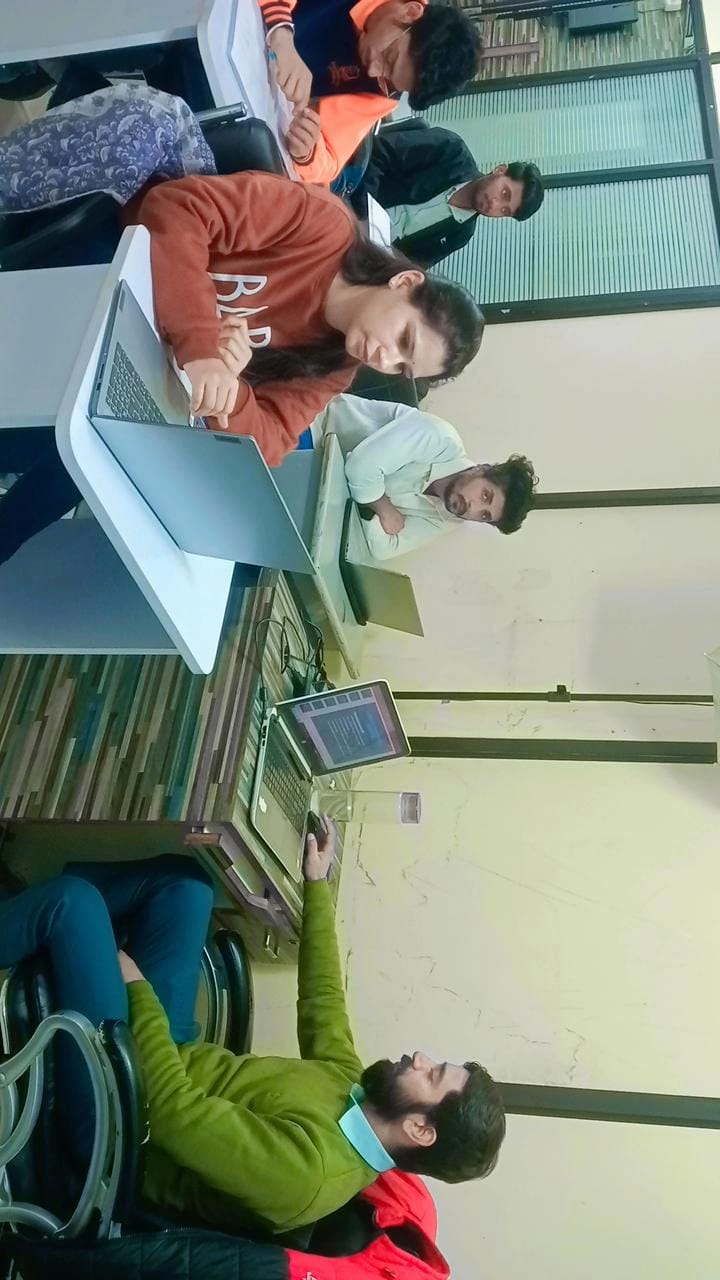

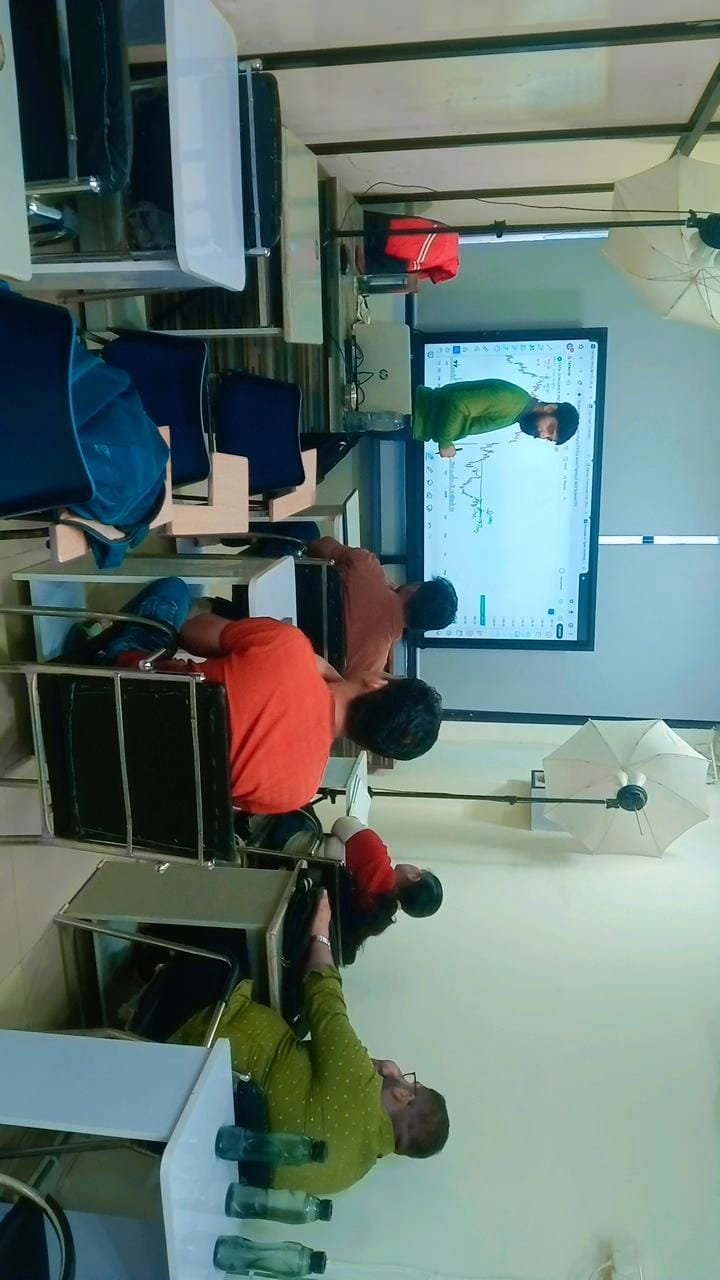

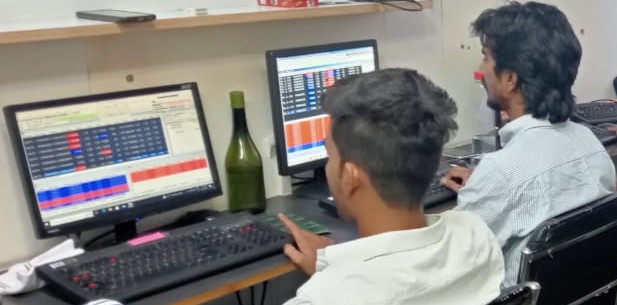

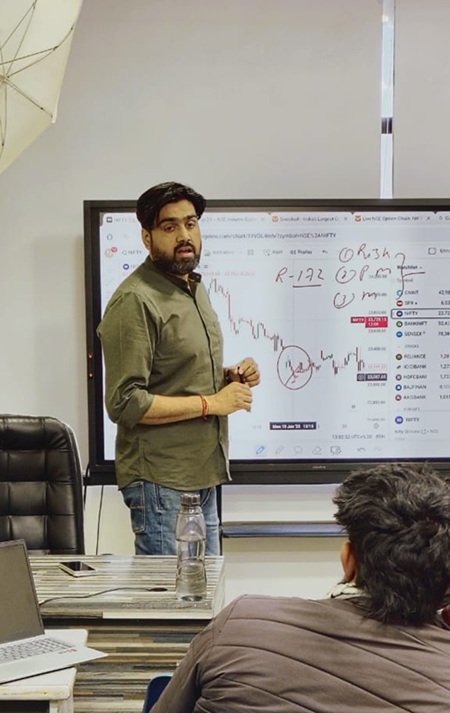

Jaipur Classroom Gallery

Tools You Will Learn

Stock Market Jobs in Jaipur

Completing a stock market course at NIWS in Jaipur can open doors to various entry-level positions in the financial sector. Below are descriptions and estimated starting salaries for selected roles:

Equity Research Analysts evaluate financial data, analyze market trends, and provide investment recommendations on stocks and securities. They prepare detailed reports to guide investment decisions.

Estimated Starting Salary in Jaipur: Approximately ₹3,60,000 per annum.

Scalpers are traders who execute rapid buy and sell orders to profit from small price changes in the stock market. This role demands quick decision-making and a deep understanding of market dynamics.

Estimated Starting Salary in Jaipur: ₹2,00,000 per annum

Trade Analysts monitor and analyze trading activities, assess market conditions, and develop strategies to optimize trading performance. They often work closely with traders to provide insights and support decision-making.

Estimated Starting Salary in Jaipur: Approximately ₹3,00,000 to ₹4,00,000 per annum

Risk Management Executives identify, assess, and mitigate financial risks within an organization. They develop risk management strategies and ensure compliance with regulatory standards.

Estimated Starting Salary in Jaipur: Around ₹3,00,000 to ₹5,00,000 per annum

Portfolio Management Executives assist in managing investment portfolios, analyzing asset performance, and making recommendations to achieve clients' financial objectives. They balance risk and return to optimize portfolio growth.

Estimated Starting Salary in Jaipur: Approximately ₹4,00,000 to ₹6,00,000 per annum

Meet Your Mentor

Meet Madan Mourya, a renowned expert with 15+ years of experience in the Indian Stock Market! As a SEBI Certified Research Analyst and NSE Certified Technical Analyst, Madan possesses a deep understanding of Technical Analysis, Option Strategies, and Fundamental Analysis of stocks. With his expertise in TechnoFunda, Madan crafts profitable trading and investment strategies for both short-term and long-term gains.

Student Testimonials

Our students have transformed their careers, achieving remarkable milestones in the stock market industry. Hear their stories and get inspired:

I had the opportunity to enrol in a course at NIWS stock market institute in Jaipur in August, and I must say, it was an enriching learning experience. The environment was conducive to learning, and I appreciated being able to apply theoretical knowledge in real time within the adjoining room. The tutor was highly professional and possessed extensive experience, providing valuable insights. The classroom experience was enjoyable, making the learning process informative and engaging. I must say NIWS Jaipur provides the best stock market course.

I'm happy to share my great experience with NIWS Institute. The teachers, especially Mr. Madan, are excellent. They taught me a lot about stock trading, forex markets, and more. I want to thank Mr. Madan and the entire NIWS team for their help and guidance. They are very good at what they do, and I highly recommend NIWS Institute to anyone who wants to learn about financial markets.

The best Institute for NISM at the Beginner level a great experience, Now I am taking offline classes and it's very helpful for starting a new journey in the stock market ☺️

As a student at NIWS, my experience has been transformative. The comprehensive course curriculum covers essential topics like technical analysis, trading strategies, and portfolio management, providing a solid foundation in both theory and practical application. The instructors, with their extensive real-world experience, offer invaluable insights that bridge the gap between academic concepts and market realities. The flexibility of online and in-person classes caters to diverse learning preferences, making education accessible and convenient. The supportive learning environment fosters growth and confidence, and the institute's commitment to student success is evident through continuous guidance and mentorship. Overall, NIWS has equipped me with the knowledge and skills necessary to navigate the complexities of the financial markets effectiveness. Thanks, NIWS 😊.

NIWS Jaipur - A good place to learn the stock market and the content within it, Technical Analysis, Fundamentals & etc. @Madan Sir, a good young mind, will teach you how to use your knowledge and patience in the market to make trades.

Who Can Join NIWS

Students & Fresh Graduates – Build a strong foundation in stock trading and investing with industry-recognized certifications and 100% job assistance.

Working Professionals & Job Seekers – Upgrade your skills, switch to a finance career, or earn extra income through stock market trading.

Traders & Investors – Learn profitable trading strategies, technical & fundamental analysis, and risk management techniques.

Business Owners & Entrepreneurs – Diversify your investments and manage finances effectively with expert-led market analysis.

Finance & Banking Professionals – Advance your career with NISM & NCFM certifications and specialized investment courses.

Online Learners & Remote Professionals – Get access to live interactive classes and recorded lectures from anywhere.

🚀 Join NIWS Jaipur and take your first step toward financial success today!

Certifications

Placement Partners

Our Facilities

At NIWS Jaipur, we combine high-end infrastructure, expert-led training, and industry certifications to provide a top-rated stock market education experience. Whether you’re a beginner or an aspiring trader, our facilities are designed to help you master the stock market. Enroll today and start your journey to financial success!

We offer both classroom and online training, ensuring flexibility for all students. Our in-person sessions at our centre in Jaipur provide hands-on market experience, while our live online classes allow learners to study from anywhere.

Our modern classrooms are designed to enhance learning with air-conditioned comfort, smart screens, projectors, and dedicated trading terminals. With high-speed Wi-Fi connectivity and real-time stock market data access, students get professional trading experience.

Before committing, you can experience a free 1-day demo class, where you get a glimpse of our teaching methodology, live trading setups, and interactive classroom environment. This session provides a hands-on introduction to stock market trading concepts.

Our courses are designed to meet industry standards, offering NSE, NCFM, and NISM certifications that add value to a student’s financial career. These certifications are highly regarded in the stock market, helping students secure jobs in broking firms, investment advisory, and portfolio management.

Practical exposure is key to success in the stock market, which is why we have a dedicated Live Trading Lab where students practice in real-time market conditions. Our market simulation tools allow learners to test strategies, analyze stock movements, and make trading decisions in a risk-free environment.

Faqs