6-Month Program in Financial Market Management (PFMM)

100% Job Placement | Learn from Industry Experts | Flexible Batches

Don’t miss out on one of India’s most rewarding career opportunities!

The financial sector is growing incredibly, and employers are actively looking for skilled professionals.

With the Program in Financial Market Management (PFMM), you can secure a high-paying job in banks, stockbroking firms, and financial institutions—but only if you act now! This 6-month job-oriented course will give you in-demand skills, hands-on training, and industry-recognized NISM & NCFM certifications to boost your employability.

At NIWS, we guarantee 100% job assistance. Our expert faculty, real-time market training, and structured career guidance ensure that you don’t just learn; you get placed!

⏳ Seats are filling fast! Don’t wait—enroll today and claim your spot in India’s financial future.

Book Your Seat Now!6 Months

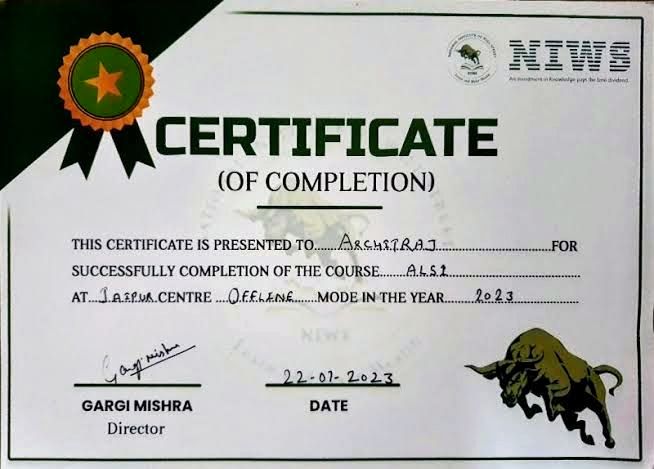

Advanced Program Certification from NIWS (Autonomous)

3 Certificates of NISM Modules

4 Certificates of NCFM Modules

100% Job Placement in Banks, Broking House

Wealth Management and Research Houses.

₹60000.00

Note: In Installments

What Will You Learn

Features of the Course

What Tools Will You Learn

Who Is This Course For?

If you want a stable, rewarding, and growth-driven career in finance, this program is your stepping stone!

Looking to secure jobs in banks, stockbroking firms, and financial institutions.

Aspiring traders & Investors wanting to master stock market strategies, traders and operators psychology, and build wealth.

Looking for a high-paying career in financial markets.

Working Professionals & businessmen who want to enhance their expertise in trading, portfolio management, and investment strategies.

Certificate

✅ Earn industry-recognized certifications to boost your career in finance.

✅ Get trained for NISM & NCFM certifications, valued by banks, stockbroking firms, and financial institutions.

✅ Validate your expertise in stock trading, investment strategies, and risk management.

✅ Enhance your resume with certifications that improve your job prospects and credibility.

✅ Gain a competitive edge over other candidates in the financial job market.

✅ Receive expert guidance and study materials to help you clear certification exams with ease.

✅ Increase your earning potential with certifications that qualify you for high-paying roles.

✅ Get associated with NIWS mentors for life time with this certificate.

✅ Stay ahead of industry trends with updated certification programs aligned with market demands.

✅ Fulfill regulatory requirements for working in stock trading, investment advisory, and portfolio management.

✅ Gain more than just knowledge—secure a certification that opens doors to top financial roles.

Faqs

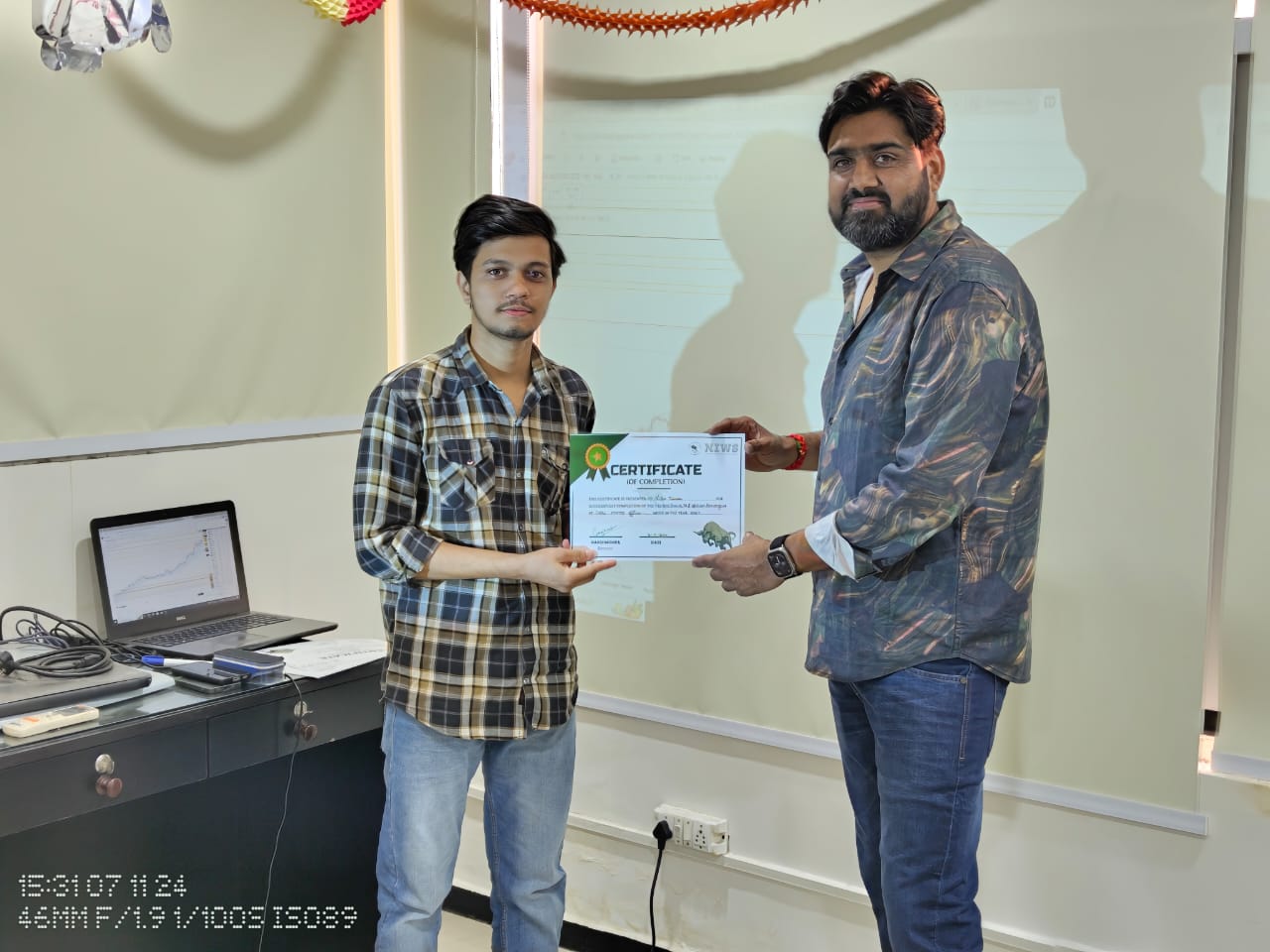

Our Alumni

Join the Leading Stock Market Institute in India" with a prominent button linking to the enrollment page.

Book Your Seat Now!