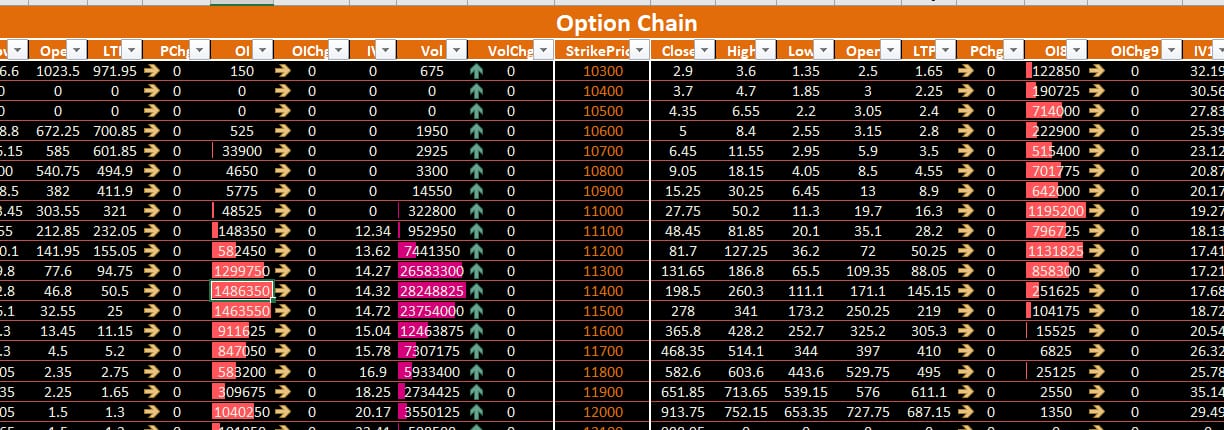

An option chain is a graphic that shows all of the stock option contracts available for Nifty stocks in detail.

Options may seem to be rows of random numbers at first glance, which might be perplexing. Option chain charts provide helpful information about a security's present value and how it will be influenced over time. An understanding of an options chain may assist investors in being better educated and making the best decisions possible in the market.

There are two pieces to an options chain: call and put. A call option is a contract that allows you the right, but not the responsibility, to purchase the underlying at a defined price and before the expiry date of the option. A put option is a contract that provides you the right, but not the responsibility, to sell the underlying at a specific price and before the expiry date of the option. The special price is also given, the stock price at which the investor will purchase the shares if the option is exercised. An option chain lists all possible option contracts for specific security, including puts and calls. For the following trading day, the option chain matrix is the most helpful tool. To gauge current market conditions, traders usually look at the columns labeled "last price," "net change," "bid," and "ask."

It's best defined as a list of all available option contracts. It encompasses both puts and calls on a particular security. It's also referred to as an Option Matrix, and it's essential for trading the next day.

Skilled users can determine the direction of price changes with the help of the Option Matrix. It also assists in determining whether there is a high or low degree of liquidity. Traders may use it to assess the depth and liquidity of specific strikes in most cases. It correctly collects the following metrics —

Executed price

Real-time bid price

Ask price

Ask quantity

Bid quantity

Options for Calls and Puts The calls and puts chains are divided into two portions. A call option offers you the right (but not the duty) to buy 100 shares of stock at a specific price and on a certain date. A put option also offers you the choice (but not the duty) to sell 100 shares on a given day at a specified price. The choices for making a phone call are always given first.

Expiration Date Options are available with a variety of expiration dates. You may, for example, purchase a call option on a stock that expires in April or another that expires in July. Because there is less time to execute opportunities fewer than 30 days before they expire, their value will swiftly depreciate. Strike, signifier, latest, variation, make an offer, offer quantity, and open interest are all terms used to describe the actions of a trader. Are the columns in the order they appear in an option chain.

Similar to the underlying stock, each option contract has its symbol. Varying options symbols are used for options contracts on the same stock with different expiration dates.

The special price is the price at which you may purchase (if you're buying a call) or sell (if you're selling a put) (with a put). Call alternatives with higher rates are frequently available cheaper than call options with lower strike prices. For put options, the opposite is true: lower strike prices translate into lower option prices. To be executable, the market price must cross above the strike price with options. For example, if a company is now selling at Rs300.00 a share and purchasing a Rs 500.00 call option, the choice is worthless until the market price passes over Rs 500.

The change column indicates how much the last deal differed from the previous day's closing price. The most recent listed price is the most current price. The transaction and the previous price is the most recent posted deal. The bidding and asking prices represent the current prices at which buyers and sellers are ready to trade.

Consider options (as well as stocks) to be significant online auctions. Buyers are only willing to pay a certain amount, and sellers are only prepared to take a certain amount. Negotiating takes place on both sides until the bid and ask prices start to converge.

Finally, the buyer will either accept the given price, or the seller will receive the buyer's bid, resulting in a transaction. You could notice that the bid and ask prices for specific options that don't trade very frequently are pretty far apart. Purchasing an opportunity like this carries significant risk, mainly if you are a novice options trader.

The premium is the upfront cost that a buyer pays to the seller via their broker to purchase an options contract. Option premiums are stated per share, which means that a single option contract represents 100 shares of the underlying stock. A Rs 50 bonus on a call option, for example, would require an investor to spend Rs 500 (Rs 50 * 100 shares) to purchase that stock.

As the price of the underlying stock swings, the option's premium moves as well. These variations are referred to as volatility, and they influence the chances of a successful choice. If a stock has minimal volatility and the strike price is a significant distance from the company's current market price, the option has a low chance of being profitable after expiration. The premium or cost of an option is expected if there is a slight possibility that it will be lucrative.

On the other hand, the bigger the premium, the greater the chance that a contract would be lucrative.

Other elements that influence the price of an option include the amount of time left on an options contract and how far into the future the contract's expiry date is. For example, as the options contract approaches its expiry date, the premium will fall since there is less time for investors to benefit.

Options with a longer time to expiration, on the other hand, have a greater chance of moving beyond the strike price and being lucrative. As a consequence, premiums for choices with more time left are often higher.

The open interest column displays how many options are outstanding, and the volume column indicates how many votes were traded on a given day. The quantity of options available for a stock is known as open interest, and it includes options purchased days ago. A large amount of sincere interest indicates that investors are interested in that stock at that strike price and for that specific expiry date.

Investors want to see liquidity, which means that there is enough demand for a particular option for them to enter and exit a position readily. However, since there is a seller for every buyer of an option, a significant open interest does not always indicate that the stock will climb or decrease. To put it another way, just because an opportunity has a lot of demand doesn't guarantee the investors who are buying it are accurate about the stock's path.

Morover, if you need to learn these skills you can join share market classes in jaipur.

1.The in-the-money (ITM) and out-of-the-money (OTM) alternatives are discussed.

2.It may be used to determine the depth and liquidity of individual strikes.

3.It assists traders in determining option premiums based on the maturity date and strike price associated with the option.

4.The option chain acts as a warning against index breakouts or significant changes.

5.Index option chains, unlike stock option chains, provide macro-level indicators. In any case, the former is an effective stock-level indicator.

6.It gives you a clearer picture of the economic Straddles and Strangulations at different strike prices. It would help them match their investments to market emotions.

7.There are two parts to an option chain: calls and puts. A call option provides you the choice to purchase a stock, while a put option provides you the opportunity to sell a stock.

8.The premium, which is the upfront charge paid by an investor for acquiring an option, is the price of an options contract.

9.The special price of an option, which is the stock price at which the investor purchases the shares if the option is exercised, is also given.

10.Options have different expiration dates, which affect the premium of the option.

For retail investors, option chains are undoubtedly the most natural way of presenting the information. The choice quotations are organized in an easy-to-follow order. Traders may determine an option premium by looking at the maturity dates and strike prices for the options they are interested in. Bid-ask quotes, also known as mid-quotes, may be shown inside an option chain depending on how the data is presented. The vast majority of internet brokers and stock trading systems provide option quotations in the form of an option chain, which may be shown in real-time or delayed data. The activity, open interest, and price movements may all be quickly scanned using the chain display. Traders may narrow down the options that are necessary to match a given options strategy.

Traders may rapidly access information on an asset's trading activity, such as the frequency, volume, and interest by strike price and maturity months. Data may be sorted by the expiry date, from earliest to latest, and then filtered further by strike price, from lowest to highest.

Start with a demonstration class.