02 Feb 2023

How Bearish Candlestick Patterns Are Formed

Candlestick charting is a highly precise and reliable way to analyse the price movement of different securities. It is more useful and valuable than traditionally used open-high and low-close bars. The tool packs data for several timeframes into a single price bar. Candlesticks create patterns capable of predicting price direction. The colourful technical tool can easily be used due to accurate colour coding.

The price movement can be displayed graphically on a chart, and according to trading, it shows a market movement. However, identifying the pattern on the candlestick chart is a subjective process. There are several categories of candlestick patterns, and we will talk about bearish candlestick patterns.

Bearish candles on the chart let you predict declining price rates in a market. These candlesticks also indicate that the number of sellers in the market has outnumbered the buyers. It can result in a drop in prices. It is similar to the supply/demand rules.

You can choose the National Institute of Wall Street for share market course in Delhi as the best destination to learn more about candlestick patterns. NIWS has course modules for potential stock market traders. The best options available to us are:

Contact our stock market experts at +91 9261623456 to learn more.

What is a Bearish Candlestick Pattern?

Bearish candlestick patterns occur when the price in the market has a decline of around 20% from the top. Each candlestick in the chart has a wick. When you find it on the bearish candle, buyers do not accept the dropping rate, although they can eventually get overwhelmed. This condition shows the weaker condition of the market.

The action taken by traders can vary with the risk-to-reward ratio. It is best to take a step when there is an uptrend. Still, you may also try to take advantage of the downtrend pattern.

You must ensure bearish reversal patterns provide reversal signals. Other indicators of the pattern are resistance and volume.

5 Powerful Bearish Candlestick Patterns to Predict Price Movements:

Check the details of the best bearish candlestick patterns before getting engaged in trading activities.

1. Hanging Man:

How to Spot the Pattern?

The trend reversal Hanging Man is easily identified with a long downside wick. But, traders find it challenging to identify a profitable location. They need strong knowledge about the market momentum, price trend, and resistance. There are some guidelines on how to search for this pattern.

-

There are both bearish and bullish bodies in the Hanging Man pattern

-

The size of the shadow is 2 times taller when compared to the body.

-

The bullish gap in the pattern increases the potential for sales.

-

Traders may use some other indicators to have the best outcomes.

Practical Application for Clarity:

Suppose the pattern has been formed at $64,000 with the upward movement of the price. The price can alter its direction, and the bearish potential gets invalidated when it moves above the higher level of the Hanging Man pattern. But, traders may use different take-profit levels to reduce the risk.

Overview:

The Hanging Man pattern is a good indicator of a price reversal and can be found after a bullish trend. After the bullish trend occurs for a long period, the pattern warns you about the reversal of the trend.

2. Dark Cloud Cover:

How to Spot the Pattern?

You can identify the pattern when there is a formation of a large black candle over the candle on the previous day. Traders choose the pattern only when it turns up after an uptrend. With the rising price, the patterns gain importance for marking a downside move. There are some other criteria for finding the Dark Cloud Cover candlestick pattern.

-

An up-bullish candle with the uptrend

-

A significant gap in the day

-

The closing of the bearish candle is below the bullish candle’s midpoint.

You can find black and white candidates with long bodies. But, the shadows are shorter or may be absent. These signs indicate a lower move in price.

Practical Application for Clarity:

The Dark Cloud Cover pattern turns up when a bearish candle follows the third bullish candle. You can successfully predict the downturn by checking this pattern. You will see how the price moves lower significantly. Moreover, traders can find a chance to enter a short position.

Overview:

It is a bearish reversal pattern with a down candlestick opening above the close of the placed up-candle. The dark Cloud Cover pattern is significant because it reveals an effect on the momentum of downsides from upsides.

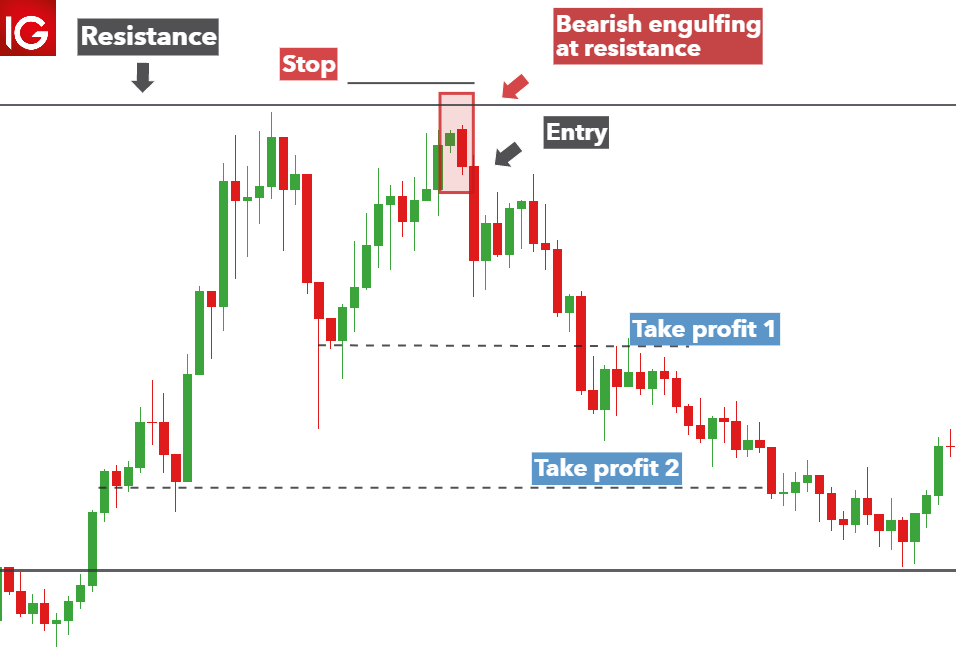

3. Bearish Engulfing:

How to Spot the Pattern?

During the trading cycle, the price rate can increase at any time. The red bearish candlesticks overshadow the bullish green candles. Thus, you can notice a signal of loss with the bullish candlestick.

Large bearish candles indicate that the selling pressure is dominant. You can detect a bearish reversal by identifying the volume of sales on the engulfing day.

Practical Application for Clarity:

While the initial price trend is in sideways, there is a downtrend pricing over time. The number of green candles gets lowered, indicating a bullish reversal (the market has several buyers).

However, buyers can lose momentum with time, increasing selling pressure. So, the bearish candlesticks become red and engulf the green ones.

This is all about the pattern, and there is a consistent decline in prices due to bearish trends.

Overview:

It is one of the bearish candlestick patterns when focusing on a bullish market. As it is about trend reversal, it happens when you find an uptrend pricing. Shorter shadows and smaller green candles can be noticed on the chart. When sellers start taking over the market and lower the price, buyers can shift their positions to become sellers.

4. The Evening Star:

How to Spot the Pattern?

This pattern is a good indicator of a price decline in the future. It is formed over 3 days-

-

On the first day, there is a large white candlestick, representing a continuous increase in the price rates.

-

The candle becomes smaller on the second day, revealing a modest price hike.

-

On the third day, you will see a large red candlestick opening at a lower price rate and closing in the mid of the very first day.

Practical Application for Clarity:

While analysing a chart, you can find 3 days started with a long white candlestick. It indicates the rise in price due to considerable buying pressure. This price hike can also be seen on a subsequent day. Finally, on the third day, the selling pressure causes a shift in the price.

Overview:

Technical analysts use this pattern to analyze the 3-candle formation. It helps in identifying bearish reversals by assessing 3 candles. Crypto traders prefer this pattern because it assists them in leaving the bull market to sustain profits.

5. The Three Black Crows:

How to Spot the Pattern?

There are some criteria for identifying the Three Black Crows candlestick pattern-

-

The uptrend will be in progress.

-

A single row consists of 3 long, bearish candlesticks.

-

Every candle should open below the open rate on the previous day.

-

In most cases, it opens at the average price level.

-

The closing of each candle should be progressively downward, establishing a short-term low.

Practical Application for Clarity:

The candlestick pattern develops after a price uptrend. There is a reversal of the trend after forming the candlestick pattern. By choosing the Bearish Reversal scans, you will find the pattern scans. It will then reveal to you several stocks in the market with profitable opportunities.

Overview:

The bearish reversal pattern comprises three consecutive long candles with a downward trend. According to this pattern, each candlestick must be comparatively long. It will open lower when compared to the previous candlestick’s open rate.

The pattern generally shows a weakness in an uptrend and a downtrend emergence. You must pay attention to the candlestick length. The last 2 candles have to be in similar sizes, and they confirm highly controlled bears.

When the last candle is small, it detects weakness. In contrast to the Three Black Crows, the pattern is called Three White Soldiers.

Conclusion:

Bearish candlestick patterns are easily identifiable for traders in the stock market. Patterns always facilitate intuitive thinking ability and increase the potential to get closer to detecting the unknown ones. Though there are several questions and arguments about stock prices, you can find a correlation with chart patterns.

You can try to check the bearish candlestick pattern to anticipate price movements. However, dealing with these patterns and stock market activities is difficult without basic knowledge. That is why you can start your learning journey with NIWS.

We are one of the reliable Stock Market Institute In Jaipur and Delhi and provide training on gaining profits in your stock trading. It has online courses with modules related to BSE, NSE, NCFM, and SEBI. Candidates can also find 100% job assistance at the end of every course.