17 Aug 2022

What are Mutual Funds. What is the Importance of Mutual Funds for Investment with Special Emphasize on Equity Asset Class

What are Mutual Funds. What is the Importance of Mutual Funds for Investment with Special Emphasize on Equity Asset Class. (Level 1)

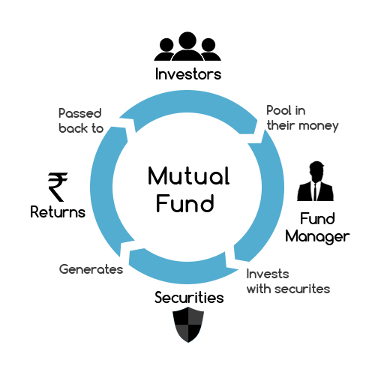

Mutual Funds is an Investment product available in the hand of the smart investor through which they can invest in multiple asset class of their choice. The asset class can be Gold, International Equity, Equity, Debt, Real Estate and Alternative Asset Class etc. The investor can invest in such schemes according to his future financial goals, the objective of the investment, the ability to take risk and time horizon of the goal.

The investor who chooses to invest through mutual funds will be able to use the service of the fund manager who will make an investment decision with professional expertise, diversification and risk management.

Who are the Regulators of Mutual Funds?

AMFI is the regulatory body that governs the Mutual Funds.

SEBI is the primary regulator of Capital Markets and RBI is also involved when investment related to foreign exchange, international markets and money market

Types of Mutual funds Based on Schemes:

Open Ended Fund: An open ended scheme allows the investor to invest and redeem the units in the scheme on a continuous basis at the current NAV prevailing in the market till perpetuity.

Close Ended Scheme: A Close ended scheme is for a fixed tenor where an investor can invest when the scheme opens and can make an exit only when the tenure of the scheme is matured. The investor will not be able to make an entry and exit. The scheme is redeemed when the maturity of the fund is over and the fund ceases to exist.

Interval Fund: Interval fund is the variant of Close ended fund which becomes open ended at regular interval for an investor to make an exit just like open ended schemes.

Types of Mutual Funds Based on Strategy adopted by the Fund Manager:

Active Fund: An Active Fund selects stocks in the portfolio based on the strategy to generate a higher return than the benchmark with the asset allocation, selection of stocks and timing to generate positive Alpha.

Passive Fund: Passive Fund invests the fund in the same proportion in companies that represent the index/benchmarks such as NIFTY50, SENSEX30. Fund Managers tend to generate returns same as index. He does not use his skill to outperform the benchmark. An investor who wants to mirror the same return of the index can invest in passive funds.

Categorization of Mutual Funds Based on Asset Class:

Equity Fund: The Fund Manager invests the fund in Equity Shares and Equity related instruments. An Investor with a high-risk appetite and long-term goal horizon should invest in Equity Funds.

Diversified Equity Fund: Diversified Equity Funds invest the fund across all Segments, Sectors and Size of the Company.

Segment of the Market: Fund Managers may focus on the size of the companies which belong to a particular segment, such as large-cap, mid-cap and small-cap, based on the market capitalization of the companies.

Sectoral Funds: The Sectoral Fund invests the fund in companies that belong to a specific sector, such as automobiles, banking, technology, etc. The risk in Sectoral funds is higher than in diversified funds as the investment is concentrated in a particular sector.

Thematic Fund: Thematic Fund invests the fund in multiple sectors and stocks that belong to a particular theme as per the economic scenario or new opportunity. Such a fund is more diversified than a Sectoral fund but still has a high concentration risk. Forex: The housing opportunity fund can invest in sectors which is a part of the housing scheme, like Cement, Metals and Infrastructure Sector.

For More information on Equity mutual Funds, you can enrol for stock market course in Delhi

Fund Based on Strategies and Style of Selection of Securities:

Growth Fund: Growth Funds invest in a portfolio of companies whose earnings are expected to grow at a rate higher than the average rate given the fundamental outlook of the economy. It aims to provide capital appreciation to investors.

Value Funds: Value Funds invest in companies which are undervalued due to short-term demand and supply scenarios with the expectation of an increase in share price when the market recognizes its true or fair value. These funds tend to have a comparatively lower risk.

Dividend Yield Fund: These funds invest in shares that have a high dividend yield. This fund pays a large amount of profit to investors in the form of dividends every year, which suits conservative investors who need regular income.

ELSS: ELSS is a special type of investment in Equity Funds that gives tax benefit under section 80C up to a limit of RS.1,80,000/- with a lock-in of 3 years with allocation in equity of 80%.

Arbitrage Fund: Arbitrage Fund is a low-risk fund that invests for a short term in the cash and derivatives segment to take advantage of mispricing. It suits an investor who tends to take advantage of low risk by hedge position and mispricing in two different segments

Advantage of Investing in Equity Based Fund:

Capital Appreciation: The investor will get the capital appreciation of 15 to 18% compounded annual growth throughout a 7, 10 and 15-year horizon.

Diversification: An Investor will get the advantage of diversification by investing a small amount every month and thereby have the advantage of not timing the market by investing directly in individual stocks.

Risk management: Diversification of the equity portfolio will help the investor to reduce Risk by allocating funds in multiple schemes based on his objective.

Tax Arbitrage: Equity fund helps the investor to gain an advantage in tax management as it provides long-term capital gain benefit as well as investing in ELSS will give principal, capital appreciation and maturity proceeds tax-free.

Startup Equity: some securities are not available to retail investors due to wholesale placements to qualified institutions. Mutual Funds provide access to such securities through their portfolio.

Disadvantage of Investing in Mutual Funds:

Higher Cost: The cost of Investing through Mutual Funds is higher given the fact that the fund is managed by professional fund managers who charge fees to render the service of investment.

To gain more insights on Mutual funds for investment, you can join Stock Market Institute in India to pursue a course in Investment Advisory and Portfolio Management.