07 Jun 2021

Option Greek

What is the Option Greek?

The Greeks illustrate the many risk characteristics that come into play while trading options. These dimensions are generally referred to as "the Greeks." The Greek letters Delta, Gamma, Theta, Vega, and Rho are included in the Greeks. There are also "minor Greeks," who are less often employed to assess risk factors. The Greeks are essential risk management tools that may assist options traders in making educated choices about trade and trade. They help determine how various variables like price fluctuations, interest rate changes, volatility, and time influence the price of an option contract.

If you're interested in trading options, you'll need to know what factors go into determining the contract price before you get started. Before you begin trading options, you must first understand the elements that govern their value and how the contract price fluctuates with the underlying stock.

Because a beginner options trader may not comprehend what causes unexpected declines and rallies in an option's price, he or she may be in for some unpleasant shocks, some of which may be beneficial, but the majority will be detrimental. I'll try to make these explanations as basic and straightforward as possible. I aim to keep things simple here, focusing on what matters to you to earn money by trading options.

Options contracts are priced using the Black-Scholes pricing model to assess their worth at any given moment. Stock options are not assets like stocks or bonds; they're contracts. They are more of a wager on the price of a stock at a future date than an investment in anything with intrinsic worth, such as a stock of a firm with profits or a commodities futures contract linked to a deliverable item.

To trade options, you must first grasp the fundamentals of the Greeks to determine how their value is determined and whether or not you will earn from them even if the market moves in the direction you forecast before the expiry date. Options are valued using the remaining time until expiry and the present asset or expected volatility due to a future event, such as earnings or a critical report.

Options will rise in value as the likelihood of their expiring in the money rises and fall in value as the likelihood of their expiring in the money falls. Options capture more of their underlying assets' movement as they grow closer to being in the money, and as they travel farther away from being in the money, they catch less of their underlying assets' movement.

Let's learn more about option greek.

Not only does the movement of the underlying instrument play a role in options trading performance, but so do a variety of other elements. It is determined by aspects like the market's direction, the pace of movement, fluctuations in the market, and time to expiry. The 'Option Greeks' are the elements that impact option trading. Option Greeks are divided into five categories:

1. Delta Options

2. Gamma Options

3. Vega Options

4. Theta Options

5. Rho Options

Each factor aids a trader's understanding of an option's performance in different conditions. Delta, for example, represents a directional risk, while Gamma represents the underlying instrument's directional rate of change. Theta measures the time value until the expiration of options, whereas Vega measures the predicted volatility of the underlying. Rho calculates the change in the value of an option depending on interest rate fluctuations.

As stated, option Greeks assist you in assessing the many risks connected with an option so that you may make an educated choice about whether to purchase, exercise your right, or exit the position. Let's look at each of the 'Option Greeks' with its advantages.

1. The Meaning and Importance of the Greek Option Delta

It calculates how much an option's price will change in response to a 1-point change in the value of the underlying instrument. For example, if you have a stock option, it will tell you how much the premium price of the option has changed in response to a 1-point change in the stock's value. Assume you purchased Infosys Option for Rs 2500 per share. It increased to Rs 2550 after the purchase. The cost of its choice will not rise by 50 points. This is when the delta of an option comes into play. It indicates how much an option's premium will increase in response to equivalent moves in the underlying instrument.

The decimal point is used to represent the delta. Deltas on calls are presented as positive values ranging from 0 to 1, while Deltas on puts are presented as negative values ranging from 0 to -1.

Advantages of Delta

1.1 The delta indicator tells you how price changes in the underlying instrument will affect your option position.

1.2 It shows you how profitable an option position is. For example, an in-the-money option with a more significant delta will make you more money than an in-the-money option with a lower delta.

1.3 Delta will tell you how likely your option will remain in the money. A more significant delta number indicates a larger possibility of your option remaining in the money, while a lower delta value indicates a lesser likelihood. So an option with a delta of 1.0 has a 100% chance of remaining in the money, whereas a delta of 0.25 has a 25% chance of remaining in the money.

1.4 It aids in taking measured risks depending on the delta value.

2. The Meaning and Importance of the Greek Option Gamma

Delta measures how a one-point change in the value of an underlying instrument affects the premium of an option. Gamma measures the rate of delta change for a one-point change in the value of an underlying instrument. As a result, delta measures price change, while Gamma measures the rate of change in delta.

Gammas range from 0 to 1 and are represented as a decimal point. It may have both good and bad implications.

Advantages of Gamma

2.1 Gamma can help you take short and long positions if you're trading options contracts.

2.2 It also aids in the implementation of advanced option strategies.

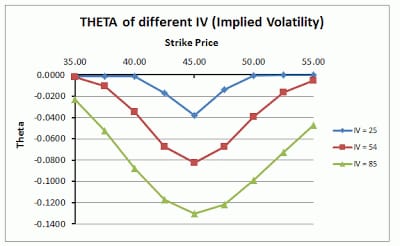

3. The Meaning and Importance of the Greek Option Theta

In the options market, time is your adversary. Options are strongly reliant on how long they have till they expire. Theta is a metric for how much an option's value has depreciated over time. It indicates how much your option loses after one day. Consider an option with a premium of ten dollars and a theta of 0.05. As a result, it will drop to 9.95 (10-0.05) on the first day, 9.90 the next, and so on.

Theta begins with a near-zero value and quickly increases, especially in the last weeks before expiration.

Advantages Of Theta option

3.1 Theta is very useful for implementing advanced methods, particularly income techniques.

4. The Meaning and Importance of the Greek Option Gamma

Vega is a formula that calculates how much an option's premium changes when the underlying instrument's volatility changes by a percentage point. Options with a high volatility premium are more expensive than those with a low volatility premium.

Ones with a high degree of volatility: As the volatility varies, Vega informs you how much the option price will rise or fall.

Let's assume the underlying instrument of an option has a volatility factor of 40%, and the current premium is 100, resulting in a vega.

If the volatility rises by 1% to 41 per cent, the premium will rise to 100.10.

Importance of Gamma

Delta and Gamma have no relationship with Vega. As a result, traders utilize it to construct delta and gamma-neutral option positions. Profits in such trades are contingent on the likelihood of an increase or reduction in volatility.

5. The Meaning and Importance of the Greek Option Rho

For a 1% change in interest rates, Rho calculates the predicted change in the value of an option. Because options are often traded for concise time horizons, and interest rates seldom move over such times, Rho is one of the less often utilized Greeks.

Importance of Rho

As previously said, Rho isn't often employed in trading. On the other hand, increased interest rates raise call prices while lowering put prices, and vice versa.

Final Takeaway

The Greeks are a valuable tool for options traders to assess the risk of various options. Investors use them to make new investment choices and assess the risk of their existing portfolios. The Greeks provide information that helps investors make informed judgments.

A pricing model, such as the Black-Scholes Model, is often used to calculate the price of an option. This model considers a variety of variables, including volatility and pricing options. On the other hand, the Black-Scholes Model is a European model that works on the premise that the option will not be exercised before its expiry date.

It's crucial to remember that the Greeks are founded on mathematical formulae. Because of the complexity of the mathematics needed to calculate the Greeks and the need for correct findings, they are often computed using an automated solution. Because they are set up to run certain formulae, you can generally receive the numbers from a broker or brokerage business. While the Greeks may forecast future prices, there is no assurance that they will be accurate.

In the end, the Greeks are there to assist in removing some of the guesswork from options trading. For those unfamiliar with the world of options, especially beginners in stock market classes in Delhi, it may be a confusing place to invest. It is critical to understand that the Greeks do not operate in isolation and are continually changing—a change in one Greek might have a ripple effect on the rest of the Greeks. By taking courses at NIWS Stock Market Institute, you'll learn that the Greeks are one technique that may be used to assist you in figuring out how much risk you're taking before making significant investment choices.