25 Nov 2022

Easy Way To Understand Candlestick Chart

Candlestick patterns are among the most important predictor diagrams for the stock market. They depict the future movement of trades and their prices based on past events.

While entering the stock market as a trader, investor, or beginner, reading the candlestick chart will be your initial study component. There are 16 candlestick charts, each involving in-depth technical analysis and fundamental analysis knowledge to predict the upcoming phase.

If you’re planning to invest or trade in the stock market, you must have prior knowledge of all these charts and components. NIWS (National Institute of Wall Street) will help you with all the basics and advanced stock market skills.

We are a renowned Stock Market institute In Jaipur (Near Kailash Colony Metro Station) and Jaipur (Riddhi Siddhi, Gopalpura Bypass), offering a wide variety of stock market courses, including-

- Career Oriented Courses,

- Courses for Investors,

- Courses for Traders,

- Online Courses.

Connect with our experts at 9261623456 or book your free online consultation now to learn more. Based on their theories and experience, our experts have listed some of the details for candlestick charts. Let’s review the facts for an overview.

What are Candlestick Charts?

Candlesticks charts were explored in Japan over 100 years ago before the innovation of the West bar and point and figure charts. Homma, a Japanese man, noted that while there was a link between rice price and supply and demand, the markets also impacted the merchants' emotions.

Candlesticks graphically represent the magnitude of price changes using various colours to indicate emotions. Traders use candlesticks to base trading choices on recurring patterns that aid in predicting the short-term trend of the price.

Different Candlestick Components:

Candlesticks are made up of different components that, if well understood, help in effective trading and discerning the market situation. Given the fact that a candlestick is a mix of one or more candlesticks to give understanding and meaning to the trader. Some of the candlestick's components include:

-

Doji

-

Hammer

-

Shooting star

-

Morning star

-

Hanging man

-

Inverted hammer

-

Spinning top

-

Three white soldiers

-

Harami

-

Marubozu

Bearish Engulfing Candlestick Pattern

Candlesticks vs. Bar Charts

The opening and closing prices are included in the sessions' high and low bar charts. The difference that exists between the candlesticks and bar chart includes-

-

In candlesticks, the connection between opening and closing is informed by the color of the body. In contrast, that connection is reflected by straight lines launching from a perpendicular angle for bar charts.

-

The bar chart places a premium on the stock's closing price concerning the earlier periods' close. On the other hand, the candlestick emphasizes the close of the opening of the same day.

-

More online Forex trading patterns than bar charts originate from the candlestick chart. However, bar charts are used to illustrate patterns. The Candlestick chart gets the lead, given that the patterns were created for them.

-

Ascertaining accuracy is easier with a bar chart compared to the candlestick. This is because of how the bar chart is organized. The bar chart comprises simple lines, which makes accuracy less difficult. Accuracy is difficult to discern compared to candlesticks, whose structures have a bigger body.

Bearish vs. Bullish Candlestick

The use of the bullish and bearish candlesticks as financial terms has long been in use, and it's agreed among etymologists that the bear term was first used before the bull.

The saying "to sell the bear's hide before one has caught the animal" is where the origins of the bull and bear may be traced. In the 18th century, trading borrowed stocks to repurchase them and return them at a lesser price eventually became known as "selling the bearskin."

A belief or behavior about the stock market determines whether a candlestick is bullish or bearish. A bullish personality behaves with the view that prices will increase. Bearish investors, on the other hand, act with the belief that prices will decrease.

Therefore, patterns and tendencies are often interpreted in bullish versus bearish terms. According to research, during a bull market, stock prices rise by at least 20% from their most recent low, while during a bear market, average stock prices fall by 20% from their most recent high.

Single Candle Pattern

As the name implies, a single candle pattern is established by just one candle. So the trading indication is developed based on a day's trading action. These trades can be incredibly productive, given that the pattern has been observed and implemented correctly.

An important factor in trading is the length of the candle while employing a candlesticks pattern. The size denotes the range of the day. The more serious the sale and purchase activity, the longer the candle. If the candles, on the other hand, are short, it can be said that the trading was overwhelmed.

Double Candle Pattern

There are variations of double candle patterns. This form of candlestick involves two continuous candlesticks, and these two candlesticks, if well observed and implemented correctly, proffer excellent trading knowledge. It is developed based on two-day trading action. The candle's length denotes the day’s trading range. The double candle pattern includes,

-

Dark Cloud cover

-

Bearish engulfing

-

Bullish Harami

-

Bearish Harami

-

Bullish engulfing

-

Tweeter Top

-

Tweeter bottom

-

Piercing Line

Triple Candle Pattern

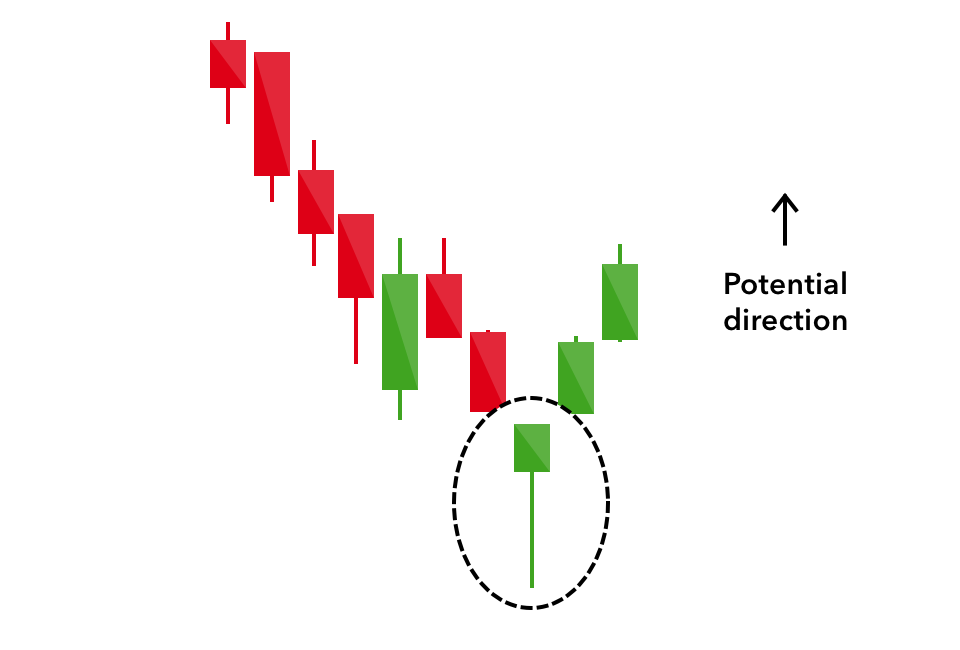

A triple candle pattern, which can be bullish or bearish, is a three-line candlestick pattern that suggests a plausible potential reversal in the present trend. It develops when a long-term trend ends, and three consecutive doji candlesticks reflect. A triple candle pattern improves the likelihood of a successful trade.

Engulfing Candlestick Patterns:

Bearish Engulfing Patterns

When sellers are more than buyers, a bearish engulfing pattern is generated. The chart illustrates this development by a long red real body swallowing a small green real body. This informs the traders that sellers are back and now in charge. And that prices can continue to decline.

Bullish Engulfing Patterns

When buyers outpace sellers, a swallowing pattern on the bullish side of the market is formed. A lengthy green actual body being sucked up by a little red real body serves as an example of this in the graph. Since the bulls are now in charge, there is a high tendency for the price to go higher.

Bearish Evening Star

An evening star is a finishing pattern. The last candle in the structure's entrance, located below the day's small real body, serves as a telltale sign. Either red or green can be found on the small real body. The last candle draws close to the candle's actual body from two days prior. The trend suggests that the sellers are gaining control while the buyers are postponing. There is a tendency that more selling could improve.

Bearish Harami

A bearish harami is a portable real body red on the inside of the preceding day's actual frame. This, however, is not a pattern to work on; it could be one to observe. The pattern suggests indecision and uncertainty from the buyer's perspective. If the price keeps following this pattern but a down candle higher after that, the uptrend, may not be affected. An additional decline is likely if there is a downward candle after this pattern.

Bullish Harami

This is the opposite of a bearish harami. A downtrend is in charge here. A small real body arises in the large real body belonging to the preceding day. This informs the technician that the trend is slowing down. If another up day comes after it, there's likely to be a more forthcoming upside.

Bearish Harami Cross

This happens when a doji accompanies an ascending candle. The prior session's actual body contains the doji. The outcomes resemble the bearish harami.

Bullish Harami Cross

This happens in a downslope, where a down candle is after a doji. The doji is embedded in the real body of the preceding session. The implications are similar to the bullish harami.

Bullish Rising Three

This pattern starts its operation with a factor referred to as the long white day. Small real bodies drop the cost as the second, third, and fourth sessions unfold, yet they fall within the long white day's price range.

Bearish Falling Three

Strong downtrends set the stage for this pattern. This is accompanied by three small real bodies that continually progress upward but do not leave the confines of the price range of the first downtrend. This pattern finishes when the fifth day makes another downtrend. This shows that sellers are in charge and that a price drop is a possibility.

Reading a Candlestick's Components:

-

Know the meanings of the various colors. If the candlestick is green or blue, you should know that the market price rises. The market price is declining, on the other hand, if the candlestick is red.

-

Watch out for the opening price, which can be located at the top or bottom of a red or green candlestick.

-

Keep an eye out for the closing price, which may be found at the top or bottom of a red or green candlestick.

-

Examine the upper shadow of the candlestick to determine the increased price. The price is the same as the opening or closing price when there is no upper shadow. This will depend on whether the market is moving higher or downward.)

-

To identify the low cost, look at the candlestick's bottom shadow. The price is the same as the opening or closing price when there is no upper shadow. This will depend on whether the market is moving higher or downward.)

Interpreting Different Candlestick Shapes

-

Understand that the short bodies illustrate that there were trading difficulties.

-

Beware of longer upper shadows to examine if buyers drove prices.

-

Look for longer, lower shadows to determine if sellers drove prices.

-

The opening and closing prices are equal when using narrow candlesticks, which is the case.

-

In downtrends, look for a short body and a lengthy bottom wick as indicators of a possible reversal.

-

Look for a short candlestick with a lengthy top wick to indicate a potential reversal in an upward trend.

Tips to Remember While Reading the Candlestick Charts

Get By Heart The Crucial Ones.

It's difficult to grasp the whole candlestick chart off-hand. However, knowing the crucial ones, such as doji, bullish and bearish bars, isn't bad. Subsequently, when you see them, you know what they represent and how they contribute to the next market trend.

Understand What Every Bar Means

When you memorize the candlestick styles, you may want to realize the justification for each of them. For example, if the rate has gone sideways for some time and now develops a massive bullish bar, this shows that the buyers are in control, and it's possible that it will start going forward over the following few bars.

Apply Them As An Additional Affirmation.

No profitable trader uses a piece of information. This means it doesn't suggest that immediately after you see a doji, the marketplace will change its direction directly. You may employ them as supplementary confirmation to a setup or tactic. Candlestick styles can assist in figuring out early modifications within the marketplace. But they shouldn't be used entirely on their own and should not input an exchange whenever you spot a doji.

Conclusion:

The candlestick chart is easy to understand if specific steps, as highlighted above, are followed. This will help one comprehend data more advanced and look for patterns contributing to favourable trading signal deals.

Book your online or offline stock market classes in Delhi seat with NIWS to learn more about stock market strategies, fundamentals, benefits, and other details.

Frequently Asked Questions:

Q. 1 Should I use any further resources except candlestick charts?

Ans: Yes, you should look at several options. This is because your judgments become more accurate the more sources you check. No candlestick pattern accurately indicates the market trend.

Q. 2 What are different candlestick patterns?

Ans: Three Line Strike, Two Black Gapping, Three Black Crows, Evening Star, and Abandoned Baby

Q. 3 How many candlestick patterns are there?

Ans: We have varying candlestick patterns, and they are employed in varying ways. These candlesticks can be divided into three basic forms. They are,

- Continuation patterns

- Bullish reversal pattern

- Bearish reversal pattern

Q. 4 What is the total number of Candlestick Patterns?

Ans: We have a total of 35 candlesticks.