01 May 2021

An All-Inclusive Guide on Intraday Trading

As trading seems a complex thing for a beginner, we are here to make it easy and help you become a professional in the same domain. Whenever you try to invest some amount in securities, you will see different options like delivery trading, intraday trading, etc. For short-term investment, people usually prefer this trading. Let's understand all the aspects of intraday trading for beginners.

What does Intraday trading mean?

The literal meaning of intraday means 'within a day,' and thus, we can derive from this meaning that it relates to buying and selling securities within the same day, and one cannot retain it in their portfolio for the next day. The transactions are performed during business hours, and these securities include stocks and exchange-traded funds (ETFs). The highs & lows that occurred during the entire day are applied to the asset to evaluate its real-time value and hold high risk. Thus it's an excellent option for day traders who don't want to invest the funds in the long-term option (more than a day). The settlement of the positions can be done as soon as the market closes for the day.

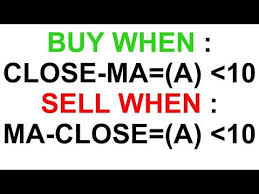

Any trader who invests in such options analyzes real-time charts for 1-60 minutes. They even use Volume Weighted Average Price (VWAP), an average price of the day, to make the right decision before buying any security.

Strategies for Intraday Trading for beginners

Below is the list of the intraday trading beginners may start with:

- Scalping: It works on grabbing small profits multiple times in a day on small investments.

- High-frequency: It needs analysis of the efficiencies and shortfalls of the security by using some complex predefined algorithms.

- Range trading: The trader makes his investment decision after evaluating the support & resistance levels, and such an approach is known as range trading

- News-based trading: As many news headlines and events can influence the stock's value; this strategy tries to determine and grab such opportunities.

Reasons behind the Popularity of Intraday Trading

The best part about intraday trading is that the position or net value of the asset is not influenced due to fluctuation that happens at night. Moreover, day traders get hiked leverage by increasing their investment ability with a higher margin. One can also protect positions by availing the benefit of a tight stop-loss order, which is a provision that enables to set off a stop price. Also, a majority of trading platforms offer extra privileges to their day traders like low brokerage charges.

Who should opt for intraday trading?

People who have the courage and time to take high risks and monitor the market fluctuations to make trading decisions every minute can choose intraday trading. The returns of this trading approach are lucrative and need expertise and a good understanding of the market. If you have time to indulge in trading for the entire day and have a good knowledge of the same, you should opt for this option.

What do we mean by 'value area'?

It is a significant parameter to analyze the market and refers to a price range in which 70% of the trade took place previously (yesterday or the day before yesterday). People use it to target the stocks and implement a rule like 'the 80% rule' to yield better profits. If the price of the stocks in the value area is lower and remains the same for the first hour of the day, there is an 80% chance that it will rise and vice-versa.

Conclusion

Although markets are always uncertain, the right strategy can help in reducing the risk. You can learn the techniques in-depth to become an expert by joining the share market classes in Jaipur. Try our courses for a better understanding of the security market.