12 Sep 2020

Advanced Technical Analysis Concepts by NIWS

The Stock Market is Fire, and Rules, Tools, and Strategy are Gasoline to win the game.

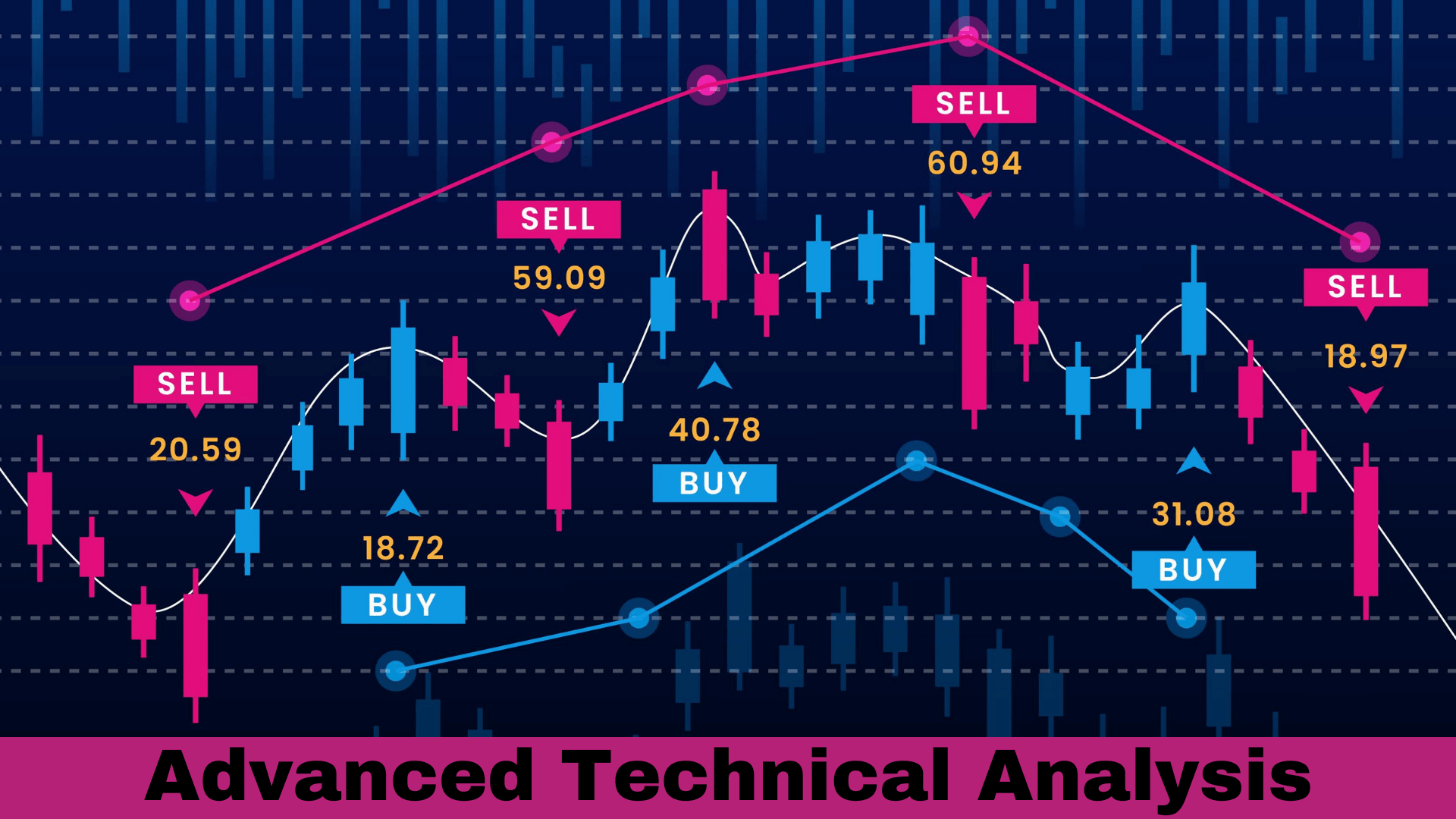

Technical analysis is a method used to predict future prices based on historical cost, volume, and open interest. Technical analysis can help investors anticipate what is "likely" to happen in the coming days, weeks, or months. Technical analysis is the study of past data to predict the future. The past data we studied will be related to price and volume to analyze future price action.

For example:

When someone visits a Palmist, he studies the lines in his hand and, based on the analysis which he has learned by analyzing the lines in the past, will help him to predict the future, which means history tends to repeat itself, which means that to predict the future one needs to have the past data which is called analysis.

Technical analysis applies to stocks, commodities, futures, indices, or any tradable instrument where the price is influenced by supply and demand, i.e., volumes. To analyze a stock or commodity, we need information like prices, volumes, and open interest on a chart, as well as applying various patterns and indicators to assess future price movements. Price refers to any combination of the open, high, low, or close for a given security over a specific time frame. The time frame can be based on intraday (1-minute, 5-minute, 10-minute, 15-minute, 30-minute, or hourly), daily, weekly, or monthly price data, and last a few hours or many years. In addition, some technical analysts include volume or open interest figures in their study of price action. The study is done with the help of candlestick charts and patterns. So you are willing to become a stock market expert by learning the different aspects of technical analysis, then join a technical analysis course at share market course in Delhi.

What is Layman Trader Phycology?

In stock market trading, the fact is that 98% of traders lose money, and 2% of traders make money. Trading is a zero-sum game, which means 2% of the traders take away 98% of traders&rsquo money. This 2% of traders have huge money flow and news flow; in technical terms, they are called market operators. In the short term, demand and supply plays an important role compared to fundamental aspects, which is the basic essence of trading. When layman traders (98% of them) enter the trade on the buy-side or sell-side based on the news flow created by the market for short-term trading, the demand/supply they create is fulfilled by the 2% operator. The Real Game Begins Now! The price will now move against the 98% layman traders and continuously move opposite until the entire 98% trader's capital is wiped out.

“Markets always move anticlockwise of layman traders.

One should never forget to fly the kite toward the wing. The trend is the best friend of the trader. Change in the market trend needs a change in the behavior of a trader because you need to flow with the market and cannot win no matter what when you try to go against the market.

A layman trader does not always sit in the wrong trade. Still, he is not able to reap the entire profits when he is in the profitable trade and wipes out his entire capital when he is in the wrong trade because he does not have a proper entry, exit plan, and stop-loss when the trade or the price action is against him. Further, the market tries to manipulate you by its actions and forces a trader's psychology to enter into a wrong trade and play with emotions and human psychology.

For example:

In the game of Cricket, when a batsman hits the first two balls of a bowler out of the court &lsquo SIX! SIX!, the bowler's psychology changes, and instead of trying to bowl him out, he tries to finish the next four balls as a DOT. The batsman takes advantage of this emotional change and scores more in the same over. Similarly, a trader enters the trade when the market opens to make a profit, but his psychology changes when he loses money in the first trade due to the wrong trade setup. Instead of entering a proper trade setup to make a profit, he tries to recover his loss, which is the change in psychology and behavior called emotions.

“There should not be any emotions when you are trading.”

How does technical analysis help you in trading?

Technical analysis helps a stock market trader enter into a trade with a proper entry plan for selecting a stock. It helps a trader have a proper exit plan for profitable trades and a wrong trade setup. Further, it indicates when a trader should try to maximize his profits with the help of tools and indicators when the volumes support the price. Practice and Patience are the keys to success in trading.

“ Tools, Rules, and Strategy is the key to success in Trading in Stock Market” Stock Market is like a game of Chess” A trader needs to have a proper strategy for his intraday/swing trading with money management, and he needs to have the data of price and volume for the study and analysis to win big in stock market trading.

Trading is not a team game. It's a one-man show! A perfect Trader is one who has the proper strategy to take

What is the basic Assumption of Technical Analysis?

Price Discounts Everything:

Technical analysts believe that the current price fully reflects all information. Because all information is already reflected in the price, it represents the fair value and should form the basis for analysis.

After all, the market price reflects the sum of knowledge of all participants, including traders, investors, portfolio managers, buy-side analysts, sell-side analysts, market strategists, technical analysts, fundamental analysts, and many others.

Technical analysis assumes that, at any given time, a stock's price reflects everything that has or could affect the company - including fundamental factors. Technical analysts believe that the company's fundamentals, along with broader economic factors and market psychology, are all priced into the stock, removing the need to actually consider these factors separately. This only leaves the price movement analysis, which technical theory views as a product of the supply and demand for a particular stock in the market.

The market price reflects the sum of knowledge of all participants, including traders, investors, portfolio managers, buy-side analysts, sell-side analysts, market strategists, technical analysts, fundamental analysts, and many others.

Price Movements Are Not Totally Random:

Most technicians agree that prices trend. However, most technicians also acknowledge that there are periods when prices do not trend. If prices were always random, it would be extremely difficult to make money using technical analysis.

A technician believes that it is possible to identify a trend, invest, or trade based on the trend and make money as the trend unfolds. Because technical analysis can be applied to many different time frames, it is possible to spot both short-term and long-term trends. Most technical trading strategies are based on this assumption. “Trade with the trend” is the basic logic behind the technical analysis.

What Is More Important than Why :

A technical analyst knows the price of everything, but the value of nothing.

Technicians, as technical analysts are called, are only concerned with two things:

1: What is the current price?

2: What is the history of the price movement?

All of you will agree that the value of any asset is only what someone is willing to pay for it. Who needs to know why? By focusing just on price and nothing else, the technical analysis represents a direct approach. The price is the final result of the fight between the forces of supply and demand for any tradable instrument.

The principles of technical analysis are universally applicable. The principles of support, resistance, trend, trading range, and other aspects can be applied to any chart. Technical analysis can be used for any time horizon, for any marketable instrument like stocks, futures, commodities, fixed-income securities, forex, etc.

Although generating calls using principle rules may sound easy, technical analysis is not easy. Success requires serious study, dedication, and an open mind.

Step-by-step analysis of any stock or commodity:

1: Overall Trend

2: Support and Resistance

3: Buying and Selling Pressure

4: Relative Strength

Technical analysis uses a top-down approach to investing.

An investor would analyze long-term and short-term charts for each stock.

Consider the overall market, probably the market behaviour index.

If the market is in bullish mode, then select the particular sector and then choose the stocks.

Supply, Demand, and Price Action:

Many technicians use the open, high, low, and close when analyzing a security's price action. Each bit of information provides information.

These will not be able to tell much separately. However, taken together, the open, high, low, and close reflect forces of supply and demand.

“ The effort and toil given in your practice and training will help a soldier save his blood in war!”