14 Aug 2023

The Importance Of Sectoral Analysis In Indian Stock Market Investing

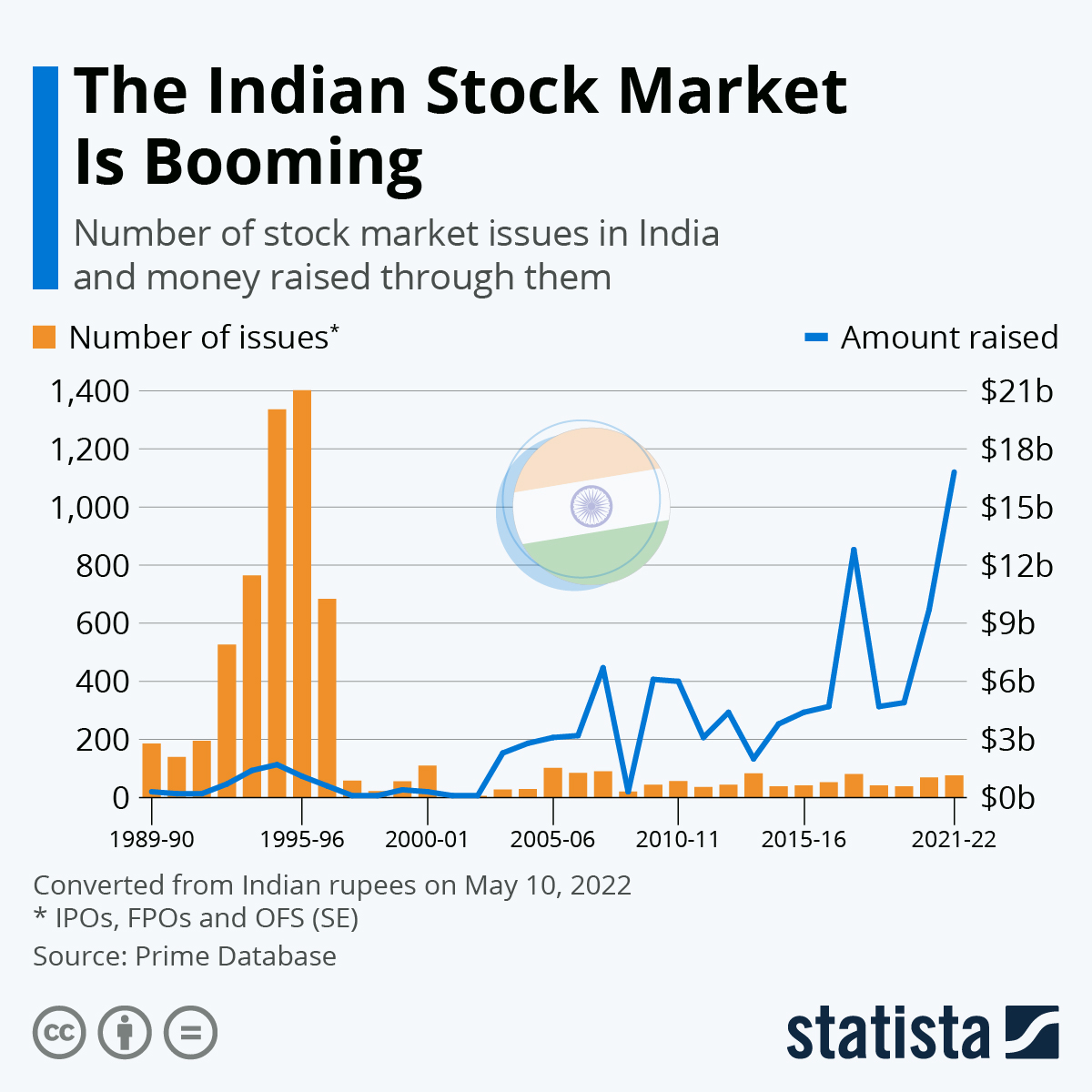

Among the most dynamic and vibrant investment avenues in the modern era is investing in the Indian stock market. A market research report shows that the Indian stock market received a 6.6% CAGR, greater returns than China and the United States in the past 123 years. The stock market offers many opportunities to create wealth through its increased investor participation and rapidly rising economy. A strategic approach is required to navigate the stock market’s complexities surpassing individual stock selection. It is where the sectoral analysis comes into the picture.

Evaluating and studying specific economic sectors are involved in sectoral analysis to identify the risks, opportunities, and trends that could significantly impact investing in the stock market. Investors can make wise choices when conducting sectoral analysis and obtain insights into the economy’s overall strength.

Overview Of The Indian Stock Market

The Indian Stock Market, often called National Stock Exchange (NSE) or Bombay Stock Exchange (BSE), is among the most active and largest stock markets. It gives the investors or traders the participation option for the business growth of a nation and companies with a network for capitalization.

Sectoral analysis in Indian stock market investing is significant due to the multifaceted and diverse nature of the economy. Investment opportunities and emerging trends are identified by sectoral analysis. Investors can capitalise on sectors poised when they study and analyse the industry-specified dynamics, regulatory environment, and microeconomic factors. It also gives them insight into customer behaviour, technological advancements, and the competitive landscape within the sector.

Significance Of Sectoral Analysis

The sectoral analysis is significant for the Indian Stock Market since it provides valuable capitalization and future growth opportunities. It also helps investors evaluate sectoral dynamics and discover potential growth options.

This in-depth analysis allows them to participate in the development and growth of the nation’s economy. Long-term wealth option is built through the market's platforms with continuous reforms, regulatory oversight, and a diversified securities range.

Benefits Of Sectoral Analysis

-

Diversification Of Portfolio

Portfolio diversification of investors is allowed through sectoral analysis. When they spread their investments throughout various sectors, their risks of exposure specified to the sector are reduced. Volatility and downturn impact in a specific sector is mitigated through portfolio diversification. The possibilities of long-term stable returns and a resilient and balanced portfolio increase.

-

Capitalization On Emerging Industries

Emerging sectors and industries with growth and development potential are identified through sectoral analysis. Investors spot sectors expected to observe futuristic growth through in-depth sectoral analysis. Early-stage investments in such emerging industries or sectors can help investors gain substantial capitalization.

The sectoral analysis also helps investors with valuable market insights and opportunities, allowing them maximum growth prospects while strategically allocating their capital.

-

Risk Management

Once sector-specific risks are understood, investors can carefully decide about their investments. They have access to many factors that could impact the sector's performance, including market competition, regulatory framework, etc. Their portfolios can be adjusted when they analyse sectors and help them mitigate and manage risks associated with specific sectors. The investment portfolio’s overall resilience and stability are enhanced through this approach to manage risk.

-

Strategies And Tools For Sectoral Analysis

Investors can wisely decide about investments when provided with several tools and strategies through sectoral analysis. The companies’ competitive position, growth potential, and financial health within a specific sector are commonly used through fundamental analysis. Exit and entry points, resistance and support levels, and market trends for investments in specific sectors are identified through technical analysis.

Investors can make wise choices and gain a valuable understanding of sectoral dynamics through market research, industry reports, and financial ratios.

-

Considerations And Challenges

Investors must evaluate certain challenges and factors. It will help them remain updated on policy changes, economic indicators, and industry news that may pose challenges to specific sectors. Continuous evaluation and monitoring are essential since market trends and cycles can rapidly change.

A thorough understanding of associated risks, drivers, and dynamics is required for sectoral analysis of every sector. Therefore, investors should be careful, get expert advice, and perform in-depth research when they decide to invest, depending on sectoral analysis.

Conclusion

Investing in the Indian Stock Market necessitates sectoral analysis since it offers a deeper understanding of each sector. As per certain reports on Indian Stock Market Prediction 2023, the Indian stock market’s anticipated growth rate seems positive and reached 8% from 7.5%. It aligns perfectly with investment choices, manages risks, and identifies emerging trends and the wider landscape of the economy. Through strategic plans and tools, investors can carefully invest in the Indian Stock Market, providing them with long-term stable returns.

NIWS - one of the best Stock Market institutes in India to learn.