03 Jun 2023

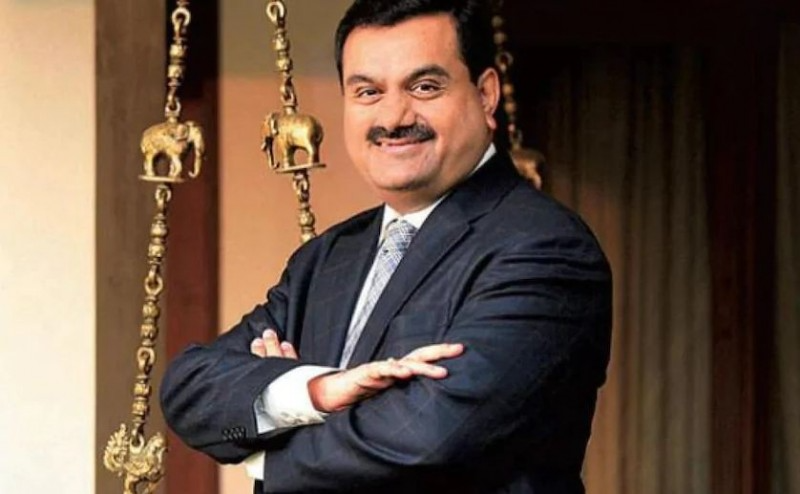

Gautam Adani's Stunning Rise Of 4.38 Billion Dollar Jump In A Single Day

Gautam Adani, the chairman and founder of the agitated Adani Group, reclaimed his spot among the top 20 richest individuals on the Bloomberg Billionaires list. The billionaire's net worth raised by $4.38 billion to $64.2 billion on 23 May as the share prices of the companies in the Adani group rose in the stock market. This move propelled Gautam Adani to 18th among the world's richest people, bypassing figures like Jacqueline Badger Mars and Zhong Shanshan.

After Hindenburg Research's research on the Adani group, Gautam Adani's net worth notably decreased, and he fell off the top 20 list on 3 February 2023. Adani, who was previously the second-richest person in the world and had an estimated worth of $154 billion in September 2022, is down by $56.4 billion since the year started.

Adani Stocks Lock In Upper Circuits

Hindenburg Research released a report on the Adani Group on 24 January. It claimed that utilising derivatives traded outside of India and US-listed bonds, Gautam Adani and his brothers had participated in stock manipulation, had influence over a large number of offshore shell companies, and had taken a short position in the Adani Group companies.

However, if you need to do the analysis of the comapanies stock for investment you need to have the right knowledge about the Stock Market, for this you can grab the knowledge about it by getting enrolled in Stock Market Course In Indore.

The research also stated that due to excessive valuations, its seven most influential listed companies had an 85% downside just on a fundamental basis. The corporation has, however, refuted every charge.

The apex court published the panel's findings, which, in contrast to what Hindenburg claimed in January, did not identify any regulatory shortcomings with reference to the price orchestration in Adani Group stocks.

Although the market regulator, the SEBI, has been given two more months to investigate the matter, the study's first findings were a massive reassurance for Dalal Street investors, and this was indicated in the share prices.

for more Stock Market knowledge join stock market Institute in India

Most of the Adani Group stocks have recovered most of their losses and appear to come back to their pre-Hindenburg report levels.